There are markets on both sides of the Atlantic that are prone to sporadic bouts of mania – and it looks as if we are witnessing a frenzy now even as the coronavirus crisis twists and turns.

Seemingly economic gravity-defying stints are being put in by the property market in the UK and the stock market in the US.

Nationwide revealed yesterday that even as the economic bad news keeps coming and we worry about a second Covid-19 wave, the average British house price has hit a fresh record high and at £224,123 is now up £8,000 on where it was in February.

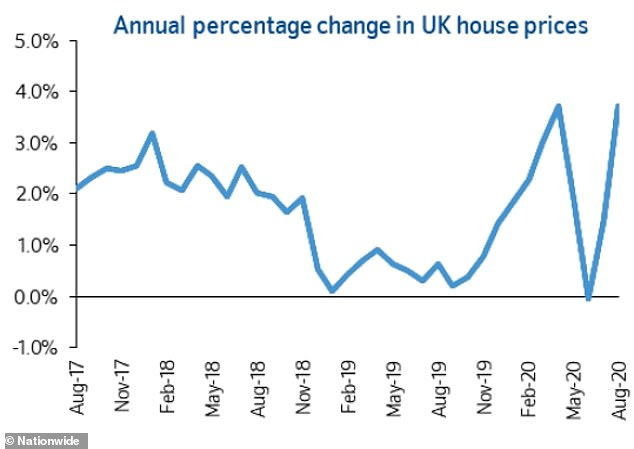

Move along, nothing to see here: House price inflation has rocketed back up since the property market freeze thawed and the market reopened in May

The lockdown mini-boom after the property market was frozen for spring has been given an extra leg-up by our summer holidays being replaced with a stamp duty holiday.

Meanwhile, over in the US, the tech giants’ shares – which had already posted astonishing rises in recent times – just keep leading the stock market higher.

The S&P 500 has hit a record high and is up 9 per cent since the start of the year, while the Nasdaq is up 30 per cent in 2020.

Meanwhile, Apple’s valuation has risen to a level greater than the entire FTSE 100 combined and Zoom – the video conferencing company most people hadn’t heard of before February but has now become a verb – is worth more than HSBC and Lloyds Banking Group added together.

Zoom’s profits are up 3,300 per cent in three months to £140m. It’s unlikely that rate of growth will be repeated, but if the company maintains that level of profitability it would rake in £560m over a year.

Lump in a hefty dose of optimism and almost double that to £1bn in profits a year and you get a nice little earner, but as a point of comparison HSBC and Lloyds expected profits for 2020, according to investing site Stockopedia, are £6.2bn.

Zoom, however, is deeply fashionable, whereas banks are not.

And that’s the UK stockmarket’s problem as a whole, it’s not very trendy. The FTSE All Share is dominated by banks, oil and energy firms, miners and lumbering financial giants.

There are plenty of consumer names that own big brands with a Buffett-style moat, but Unilever, Diageo and Reckitt are not the names being dropped by the new breed of younger stock pickers hunting big and fast returns.

They’d rather keep chasing Tesla shares higher, spurred on by claims that people just don’t understand how it’s not just a car company but one that will change energy, space, AI and much more.

The high-flying tech stocks have combined with a resurgence of individual share buyers, with a Bloomberg Intelligence report suggesting they accounted for 19.5 per cent of shares traded in the US market in the first six months of the year compared to 14.9 per cent last year.

On same days it is believed they have made up a quarter of market trading, a phenomenon fuelled by social media and free trading apps, such as Robinhood and Charles Schwab.

The broad S&P 500 US stock market index has risen to record highs after bouncing back from the coronavirus crash

Tesla’s shares, which trade on the Nasdaq index, have more than quadrupled in value this year

Yet, the temptation to mock felt by some more experienced investors should be avoided.

The spectacular rise of the US market and tech shares since the coronavirus crash bottomed out has proved many doubters wrong (for now).

Dismiss it as a FOMO rally if you will – and that fear of missing out label certainly seems to sum up quite a lot of the return chasing – but it is also clear that we may have underestimated rather than overestimated the tech stars’ resilience and profit machine tendencies.

Nonetheless, you cannot help but feel that while this may continue for some time longer than seems rational, things have already gone too far.

House prices have remained stubbornly above the long-term average ratio to wages despite the succession of crises thrown at the property markets since the credit crunch in 2007

The same is true of the UK property market. Of course, the gains have been far less spectacular but expectations of a slump for an already overpriced market after the pause button was pressed have proved wrong.

Instead, in the face of relentless bad news on the economy and jobs, we have had a mini-boom.

This had started before the stamp duty holiday, but it has added to the upbeat mood and I know of a number of people who are considering moving home and want to get it done before they miss out on a potential tax bill saving at the end of March 2021.

Of course, this may prove a false economy: saving £15,000 on stamp duty, while paying £25,000 more for a home in a busy market that promptly suffers once the deadline passes.

But that false economy claim may even be a false argument, people might get more for their property while sentiment is up – and they aren’t going to sell their new home anytime soon.

Meanwhile, if the numbers work, then simply finding it easier to sell and benefitting from more potential homes to buy as extra sellers come to the market might make the move more attractive anyway.

Houses in this country may overvalued – they are almost as expensive as they have ever been compared to wages, while rental yields are near all-time lows – but people clearly still want to move home.

So, do we underestimate the resilience of Britain’s housing market too?

As with the US stock market boom, however, there is a detached-from-reality feel to the UK property market right now, as both relax under the shade of the magic money tree.

The question is: if the cheap money just keeps flowing from central banks, what will it take to derail them?

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.