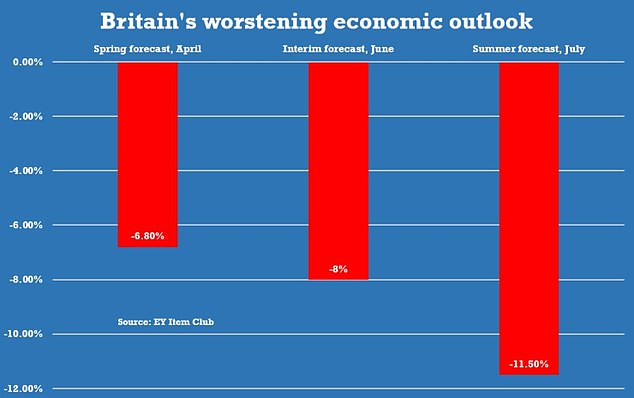

Britain’s coronaphobia means the economy could take FIVE YEARS to recover with unemployment hitting three million when furlough ends and GDP slumping 11.5% this year

- EY said it expects the UK’s GDP to remain below 2019 level until 2024

- They blamed higher-than-expected levels of ‘consumer caution’ on High Street

- Unemployment could hit 9% after the furlough scheme winds down in autumn

Britain’s economy could take five years to bounce back to pre-pandemic levels because of worse-than-expected coronaphobia, leading economists warned today.

Experts at big four consultancy firm EY said that they expect gross domestic product (GDP) to remain below where it was in 2019 until 2024, dealing a blow to hopes of a rapid recovery.

They blamed higher levels of ‘consumer caution’ after Boris Johnson allowed retailers to reopen their doors with tight anti-virus restrictions in place.

While it believes the recession is already over, the depth of the economic crisis in the spring means the UK will take some significant time to fully recover.

It warned that the UK’s jobless could more than double to over 3 million people when the furlough scheme winds down in the autumn, with the unemployment rate going from 5.1 per cent to 9 per cent.

The consultancy’s experts believe that GDP will contract by 11.5 per cent this year in the UK, well worse than the 8 per cent they predicted just a month ago. It will then bounce back to notch up 6.5 per cent growth in 2021.

Consumer spending will fall consumer spending to fall 11.6 per cent over the course of 2020, before rising 6.6 per cent in 2021 as the labour market starts to recover.

Howard Archer, chief economic adviser to the EY Item Club, said: ‘Even though lockdown restrictions are easing, consumer caution has been much more pronounced than expected.

‘We believe that consumer confidence is one of three key factors likely to weigh on the UK economy over the rest of the year, alongside the impact of rising unemployment and low levels of business investment.’

‘The UK economy may be past its low point but it is looking increasingly likely that the climb back is going to be a lot longer than expected.

‘May’s growth undershot even the lowest forecasts.

‘By the middle of this year, the economy was a fifth smaller than it was at the start.

‘Such a fall creates more room for rapid growth later, but it will be from a much lower base.’

Under the high-level numbers the economic contraction will have a serious impact on households up and down the country, with employment set to double according to EY.

It forecasts a 3.9 per cent point jump to 9 per cent of the population being unemployed at the of of this year and the beginning of next.

It is a fear shared by many in the government.

The Treasury has promises to pay £1,000 per employee for businesses who bring back furloughed staff to work.

Mr Archer said: ‘The labour market’s performance is key to the economy’s prospects over both the short term and further out.

‘Job losses and poor real wage growth are expected to hold back consumer spending, although the Chancellor’s instinct to focus on jobs in his Summer Statement should provide some support.

‘It is possible that the Chancellor will look to provide further help for the labour market in this autumn’s budget.’