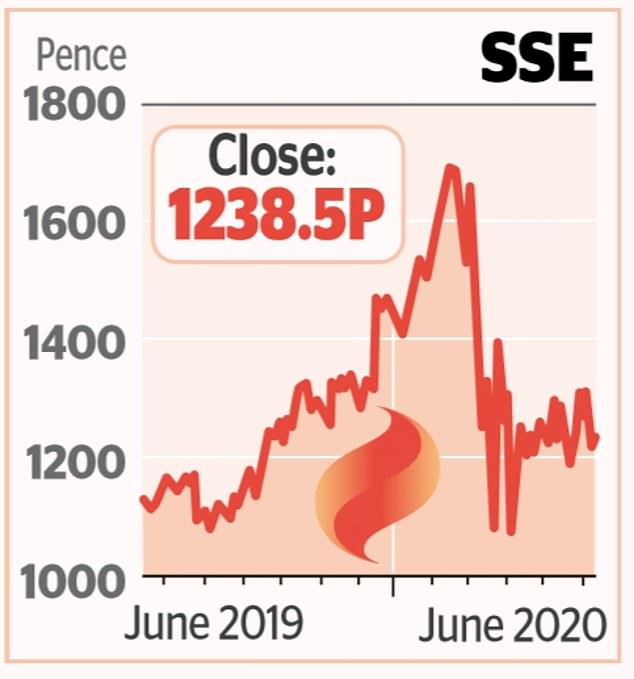

Having hit a near 10-year high in February, SSE’s shares have fallen almost 30% since

SSE is revealing its full-year results on Wednesday – and investors will desperately be hoping the energy group manages to spark some life into their portfolios.

Just a year ago, shares in utilities titans were sliding due to fears that a Corbyn government might win power and pursue a chaotic programme of nationalisation. Now, the world is a very different place.

Instead of politics, it is fuel prices due to the Covid-19 crisis and a lowered price cap on energy bills which have been weighing on SSE’s share price.

Having hit a near 10-year high in February, SSE’s shares have fallen almost 30 per cent since then.

But Emilie Stevens, an equity analyst at Hargreaves Lansdown, says ‘it should be largely business as usual for companies tasked with keeping the lights on and water flowing in the UK’.

The last the market heard, SSE was still planning to pay a full-year dividend of 80p per share. Not to be sniffed at when many others have been axing payouts. But the dividend was subject to the impact of coronavirus.

The outlook for SSE is mixed, but the company has never been through a situation like this before. Investors should be watching closely.