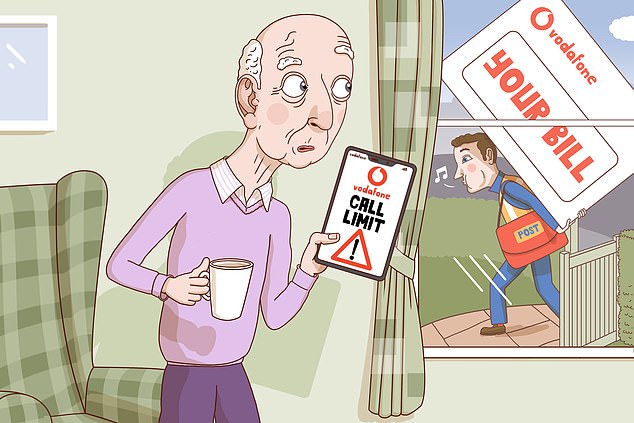

My 89-year-old father went way over his monthly call limit during lockdown and, over three months, Vodafone has taken more than £1,000.

The company called him from an overseas call centre and he did not really understand what the person was saying.

He was advised to go to Vodafone’s store or website, but the store was closed during lockdown and he does not use the internet. I could not visit him for six weeks, or I would have picked this up sooner.

Over the limit: V.R.’s father’s phone was his lifeline during the isolation of coronavirus lockdown

I asked Vodafone to look into his case, and it offered £150 as compensation which we have refused.

My father has had the phone for three years, and the firm no longer sell the package he was on. This phone was his lifeline during isolation.

V. R., Ramsgate, Kent.

Mobile phones can be complex for elderly relatives, as they may not understand the potentially extreme consequences of going over the call limit.

I am pleased to say that when I contacted Vodafone it immediately refunded the £1,134.33 your father had paid as a result of going over his limit.

It has moved him on to a package with unlimited minutes, so he can stay in touch with his family without fear of big bills. I have recently mentioned that most mobile phone companies now have modestly priced packages with unlimited minutes and texts.

If you have an elderly relative, it really is worth investigating whether they would benefit from moving to one of these for peace of mind over bills.

I got my energy from First Utility, which has become Shell Energy. I was paying £300 per month on heating and electricity for my two-bedroom bungalow.

Assuming there was a fault, I had a smart meter installed and thought I would be getting a large refund. But this was not the case. I have since moved to a new supplier which is charging me £111 a month.

R. F., London

I am afraid your energy situation is rather muddled. Shell Energy says your consumption fluctuated a lot. Your direct debit was reassessed several times, both upwards and downwards.

In your longer letter, you mention getting a big final bill. This was largely because you left within your contract period, so triggered a £150 exit penalty.

Shell Energy based this bill on figures sent by your new provider. You owed £323 on gas and £106 on electricity.

You also had £73 outstanding from previous bills, adding up to a total of £652 with the exit fee. Was your move set up by a third-party firm? If so, was it aware of the stiff exit penalties?

Check your final bill from Shell and the first from your new provider to make sure the figures match.

Ask your new provider to set up a meter check, too, to be sure that your energy consumption is being measured accurately. And be wary of that £111 figure, which is just what you are paying and may not reflect your actual consumption.

My husband and I pay £14.95 a month for a Lloyds Gold account purely so I can get travel insurance. This does not cover my husband as he is 81.

In April, I asked Lloyds to suspend the payment until I could travel again. To my mind, it was charging me for something that I could not use.

It suggested closing the account, but I would not have been able to open another one, as it is not available to new applicants. The only other account I could open to get travel insurance is the Platinum one, with a monthly fee of £21.

Eventually, the bank refunded the fees for March and April. I recently asked it to refund the May and June fees, as there are still travel restrictions, but it refused.

V. M., Eastbourne, E. Sussex.

The advice you received is sensible. I am not sure of your age, but why not just cancel the account and buy travel insurance if and when you can go away?

The Gold account includes worldwide travel insurance, card loss assistance, car breakdown cover and mobile phone insurance. You tell me you cannot use the latter two.

Lloyds says it does not refund fees for this account because you are covered by insurance even if you do not use it.

The payment you received was in recognition of its slow response to your initial inquiry and Lloyds has added a further £29.90 as a goodwill gesture.

But your letter is a reminder to all of us to review insurance — such as travel, medical or motor — that we may not be able to use, or that we may be paying far more for than our actual usage warrants.

We love hearing from our loyal readers, so ask that during this challenging time you write to us by email where possible, as we will not pick up letters sent to our postal address as regularly as usual. You can write to: asktony@ dailymail.co.uk or, if you prefer, Ask Tony, Money Mail, Northcliffe House, 2 Derry Street, London W8 5TT — please include your daytime phone number, postal address and a separate note addressed to the offending organisation giving them permission to talk to Tony Hazell. We regret we cannot reply to individual letters. Please do not send original documents as we cannot take responsibility for them. No legal responsibility can be accepted by the Daily Mail for answers given.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.